Advertisement

THE IPO REPORT

Targeting a NASDAQ Uplist Attracts All Eyes

iQSTEL Inc. (IQST)

Visit the website for additional information: https://www.iqstel.com/

It’s not everyday that a US-based, multinational, fully reporting, and audited publicly listed telecommunications and technology company prepares to uplist to NASDAQ. The Telecom industry continues to see major expansion across the globe and iQSTEL Inc. (IQST) is making waves on a global scale as their service reach continues to expand. The planned uplist to NASDAQ could be the key to iQSTEL Inc. (IQST) being the next major portfolio play, much like Amazon, NVIDIA, GOOG and others from their early days.

There are many companies, well known and not well known, that provided massive returns to early investors. Companies such as Ford (F), Coca-Cola (COKE), Apple (APPL), NVIDIA (NVDA), Advanced Micro Devices (AMD) and Seaboard (SEB). These provided returns of 10x, 20x, 100x and more.

What if you put $1,000 into Tesla (TSLA) back when it IPO’d? Where would your portfolio be today?

The Tesla chart (TSLA) brings the visual home with a move from $1 (Split adjusted pricing) back in 2011, to a high in 2022 of over $400. That initial investment, at the peak, was valued at over $400,000, with a current value of $250,000. These aren’t a once in a generation companies, but many are companies that just aren’t splashed all over with ads on TV, websites, etc. iQSTEL (IQST)has been in the accumulation phase, with a price that has been trading the channel between $0.15 and $0.20 for the past few months, and looks ready for a potentially big move.

Tesla (TSLA) chart from Yahoo Finance

Changing the Game in Your Favor

A company like iQSTEL Inc. (IQST), virtually undiscovered by Wall Street, is just the type to bring significant changes to your portfolio. In the past 5 years alone, iQSTEL Inc. (IQST) has grown their revenues by over 10 fold, from $13.8M (2008) to $144.5M (2023), and management forecasts reaching almost $300M by fiscal year end.

Building strong companies starts with a solid management team and iQSTEL Inc. (IQST) has done just that. Experts in their fields with many years of real world experience have come together in building iQSTEL Inc. (IQST) and it’s subsidiaries and ventures.

The breadth of their customer base is only a small indication of where iQSTEL Inc. (IQST) is headed with their NASDAQ uplist, continued acquisitions and growth plans.

IQSTEL’s largest customers (Source: iQSTEL website)

A quick list of key points about iQSTEL Inc. (IQST):

-Massive acquisition in the works, potentially putting the company in the $1B+ in revenues category by 2027

-11 subsidiaries acquired to specifically target top executives, strategic customer relationships and international growth

-Moving to consolidate the subsidiaries into a streamlined telecom powerhouse as part of the NASDAQ uplist

-Major market exposure across Telecommunications, Fintech, Electric Vehicles and Metaverse

Major market details from press releases:

*VoIP, SMS, International Fiber-Optic, IoT and Blockchain platform

*Master card debit card, US Bank Accounts (non-SSN required), Mobile App

*Electric motorcycles and plans for a mid-speed car

*Artificial intelligence (AI) enhanced immersive metaverse white label platform

iQSTEL Inc. (IQST) continues to see strong financial’s and growth across their business lines. The latest 10Q highlights, further detailed in their news release ( https://finance.yahoo.com/news/iqst-iqstel-announces-126-revenue-165700311.html ) are shown here:

-126% revenue growth for the 6 month period, year over year

-53% revenue growth from Q1 2024 to Q2 2024

-57% jump in gross profit from Q1 2024 to Q2 2024

-Targeting $290M for fiscal 2024

-Positive net income for first half of 2024 (without the $2.73 non-operating expense)

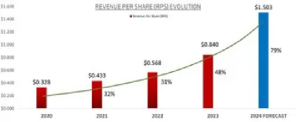

Increasing Revenue-per-Share as shown in this chart:

Source: iQSTEL press release https://finance.yahoo.com/news/iqst-iqstel-announces-126-revenue-165700311.html

Read up on the latest iQSTEL Inc. (IQST) news at Yahoo Finance: https://finance.yahoo.com/quote/IQST/

The current price has iQSTEL Inc. (IQST) trading under $0.20, a discount to where they will be trading once the NASDAQ uplist is complete. The stock already has a long time frame trading range as well, reaching well past $0.30 3 times in the past 2 years. As word on the NASDAQ uplist continues to spread, we foresee new highs being made as new investors begin accumulating.

NASDAQ uplist will completely change the landscape with the massive expansion of the investor pool available to trade IQST. Don’t let this be one of those ‘I regret I didn’t invest early’ stories.

GPO Plus, Inc. (GPOX)

Visit the website for additional information: https://gpoplus.com/

The IPO Report

About | Privacy | Disclaimer | Contact

Protected by copyright laws of the United States and international treaties. This website may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of STOCK MARKET IPO, INC, 110 Wall St., New York, NY 10005

*Disclaimer: While the examples above are real, the results may not be typical. All investing involves risk and you should never invest more than you’re prepared to lose.

©2024 Stock Market IPO

Advertisement

THE IPO REPORT

Next stop NASDAQ, Form 10 Filed. Green Energy Giant in the Making

Instability across the world is driving countries to become self sustaining via alternative energy

sources. Solar, wind, waves and geothermal are the main growth sectors underneath the green energy

umbrella.

The fastest growing green sector is solar energy. With over 13 million renewable energy jobs, solar

comprised 4.3 million of those in 2021 (according to the UN). Solar Integrated Roofing (OTC Pink:

SIRC) is one such rapidly growing company, providing jobs across multiple disciplines, in the

alternative energy sector.

Filing of the Form-10 is a stepping stone for Solar Integrated Roofing’s (OTC Pink: SIRC) move to

NASDAQ up-listing. Such a move will attract major investment banking, hedge funds and more, which

moves the stock into a major accumulation phase.

Image source: LinkedIn profile ( https://www.linkedin.com/in/david-massey-96459936/ )

Small Cap Voice interviewed David Massey, CEO of Solar, in October. The full audio interview, along

with a written excerpt, can be accessed here ( https://finance.yahoo.com/news/solar-integrated-roofingcorp-ceo-011000547.html )

MoneyTV with Donald Baillargeon interviewing Solar Integrated Roofing (OTC Pink: SIRC) CEO

David Massey released earlier this year is available at this link: https://vimeo.com/701737348

Positioning itself at the cutting edge, Solar Integrated Roofing (OTC Pink: SIRC) is set to take

investors on a massive profit ride.

Imagine if you had invested $10,000 in Apple, IBM, Amazon or Google’s IPO. These companies

provided returns of 100’s and 1,000’s of percentage gains. Currently trading at $0.15, Solar Integrated

Roofing (OTC Pink: SIRC) is poised to see massive gains as they continue their journey to the

NASDAQ.

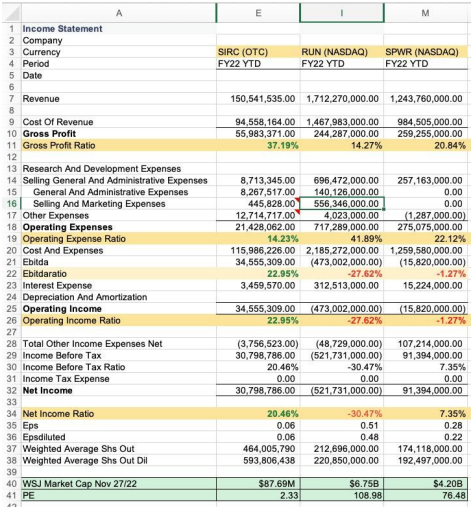

Compare Solar Integrated Roofing (OTC Pink: SIRC) to NASDAQ Sunrun (RUN) and SunPower

(SPWR) companies:

Solar Integrated Roofing (OTC Pink: SIRC) is eclipsing the big boys with a 37% profit, more than

double Sunrun’s figures and near double SPWR’s YTD figures.

Now is the time to strap in for the massive move that is expected as market consolidation,

capitulation, as well as investment, has set the stage for alternative energy technologies to take the

global lead.

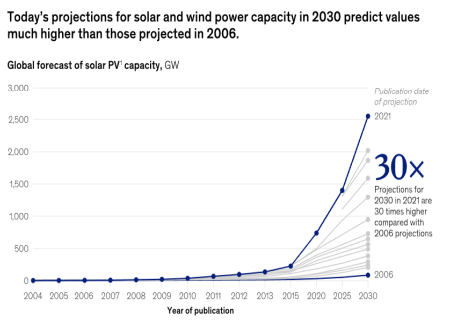

Source: McKinsey.com

We are entering the strategic global growth phase

You want forefront technology? Solar is it, even Google has a tool to facilitate checking your home or

office building: https://sunroof.withgoogle.com/

Renewables’ total is 19.8% of the energy produced in the USA. Data from the EIA

(https://www.eia.gov/tools/faqs/faq.php?id=427&t=3). With the latest government investments, tax

breaks and other incentives, this number is expected to significantly increase over the next few years.

Much like the 2021 comparison to 2006 projects above, the anticipation is that 15% will be the low

end, with upwards for 30% being the ambitious target for solar sourced energy by 2030.

Why Solar Integrated Roofing (OTC Pink:SIRC)?

– Revenue in the third quarter increased 333% to $57.3 million, as compared to $13.2 million in the

third quarter of 2021.

– To Provide Solar, Storage and EV Charging Solutions to Multiple Hard Rock Hotel Properties

Globally

– Q3 net income increased to $6.2 million, as compared to a net loss of $1.7 million in Q3 2021

– Filed Form 10 registration statement, one of the final steps needed to complete the NASDAQ up

listing.

– Q2 2022 revenue grew 746%, up from $7.8 million in Q2 2021

– Awarded 5-year blanket purchase agreement with the U.S. General Services Administration as part of

the $5 billion in federal funds allocated to EV charging installations in the Biden Administration’s

Infrastructure Bill (source: https://finance.yahoo.com/news/solar-integrated-roofing-corp-reports123100702.html )

– Introduces innovative low income solar financing product to non-profit commercial entities